Are you looking for a solution to deal with the herculean task of state-wise constantly changing sales tax compliance? If so, then TaxJar Review 2024 is all you need to read!

For businesses, sales tax compliance can be a tedious and time-consuming process. It's also subject to frequent changes at the local, state, and federal levels. That is why AI-driven compliance solutions can turn out to be a game changer.

By automating the process, companies and individuals can reduce the cost of manual entry, error checking, and filing. With automated sales tax compliance, businesses can eliminate potential errors and avoid costly penalties and fees.

Not just that, tools such as TaxJar that help with on-time automated sales tax compliance can be a major advantage for businesses as it can save them time, money, and resources. With the help of AI, businesses can ensure that they stay compliant with all applicable sales tax laws, regulations, and requirements. Plus, the collective reports provided by these tools are also quite good.

TaxJar helps do “Sales Tax Compliance for Modern Commerce.” The software takes into account the sales taxes from all your connected sales channels. But is it the right tool for your business? Let's find out:

What is TaxJar? TaxJar Review

TaxJar is a ‘stripe' company that is helping sellers and businesses manage their sales tax compliance with a modern approach. The cloud-based platform works by automating the sales tax life cycle on all major sales platforms and removing that burden from the owner's shoulders. The software helps you simplify the entire process of sales tax compliance with its innovative technology and award-winning support.

Be it calculations, sales tax Nexus tracking, reporting or filing, TaxJar has got your back. With automated tax compliance across 11,000 jurisdictions, the tool ensures you always stay ahead in the game and far away from errors and missed deadlines.

Another great advantage TaxJar brings on board is its multi-channel integration for better tax management. Features such as “AI-driven product categorization, a real-time calculation engine, a flexible API, and aggregated transaction reports” make management flow seamless and, thus, help you focus more on your business growth.

The sales tax compliance platform provides solutions for enterprises, small businesses and industries such as retail, medical, SaaS, services and food and beverage. Over 20,000 businesses trust TaxJar for their sales tax compliance, including big names like Land Rover, Curology and Shein.

An excellent resource center for knowledge and a professional customer service team make your sales tax experience remarkable. The tool instantly calculates sales tax with the latest rates and address validation. TaxJar automatically submits error-free returns and remittances and provides you with well-analyzed easy-to-understand reports.

Start a Free Trial of TaxJar

FREE TRIAL

Use our verified TaxJar Coupon to avail a 30-day Free Trial of TaxJar and get along with all of its features.

Get TaxJar for just $19

FREE TRIAL

Use this verified TaxJar promo offer and get started with TaxJar for just $19/month

How does TaxJar work? Honest TaxJar Review

When done manually, the complete flow of sales tax compliance can be very confusing and tiring. But TaxJar helps simplify each step, and that is how it provides accuracy as well as efficiency. Be it determining the Nexus, filing the taxes or making reports, TaxJar does it with the highest professional standards.

Here is how the platform works:

1. Connecting your Account: Thanks to its pre-built integrations, you can easily connect TaxJar to your e-commerce or ERP platform.

2. Identify Economic Nexus: The software has an inbuilt Nexus Insights Dashboard, which helps you stay ahead in the game with its powerful state-wise tracking.

3. Accurate Sales Tax Calculations: The software's “real-time calculation engine and sales tax API” calculates product-specific sales tax during checkout in an instant.

4. Sales Tax Reports: Their advanced updated dashboards assemble data from all your accounts to provide you with the latest insights into your “transactions and tax liability”.

5 .Auto-File and Remit: This is where the automation comes in handy; TaxJar automatically files and remits your taxes and calculates accurate returns for each state you are enrolled in.

TaxJar Features: How can it help Manage your Accounts?

Automated Sales Tax Compliance helps its users manage and control the financial flow. And taking into consideration how important but messy taxation can be, TaxJar brings a lot to the table.

Let's have a look at all its exceptional Products:

Sales Tax Compliance Platform:

TaxJar helps simplify complex tax compliance tasks. It does so accurately by calculating sales tax, smart product classification, and proper multi-state filing management. It seamlessly integrates with e-commerce and ERP platforms for high performance and flexibility. The Nexus Insights Dashboard helps users track their nexus exposure and provide notifications. The comprehensive state-by-state sales tax reports give you a better look at the flow.

Real-Time Calculations:

Accurate calculations are the first step TaxJar takes toward precise tax compliance. Based on the “customer's state, county, city, and even district,” the API performs its sales tax calculations. You can be certain of smooth transactions with real-time tax data and laws. They have a team dedicated to constantly monitoring the changing tax rates. The tool performs rooftop-level calculations on every sale and charges them with accurate rates based on their jurisdiction. You can check out TaxJar Accuracy and Filing Guarantee for more information.

Sales Tax Reports:

Apart from sales tax compliance, the tool provides you with The bring together your multi-channel transactions into one dashboard. This also includes “state-by-state reports with the city, county, and special district breakdowns.” They also provide reduced and exempt item taxability reporting for enhanced review and analysis. With data imported from all platforms, you save hours of time and manual effort. The up-to-date comprehensive view of all your sales tax data may help with profitable decision-making.

Nexus Insights:

Economic Nexus with TaxJar means next-level tracking and management. The nexus criteria for each state are different; thus, it becomes a complex moving target. But TaxJar helps monitor nexus exposure with its easy-to-use dashboard and notification system. You get alarmed when it is time to register in a new state.

Filing and Remittance:

Taxjar helps you automate sales tax filing and remittance because tax filing every time is very critical. Their service is built on best-in-class technology and is super easy to handle. Once you register in a particular state, the data is collected from your e-commerce platforms or ERP systems to prepare and submit the return. The tool manages all your filing details and deadlines, which allows you to focus more on your business leaving behind the stress of tax filing. The advantages include: never missing a filing date, reduced processing time, and more accurate results.

Integrations of TaxJar:

TaxJar integrates with some of the most popular ecommerce platforms, including Amazon and Shopify. The modern architecture and API help calculate sales tax right away. The integration functions with top-level performance as it uses tested and certified code. You can customize your integration as the tool comes with detailed documentation and open-source clients on GitHub.

Here is a list of TaxJar's official integrations.

- Amazon

- BigCommerce

- eBay

- Etsy

- Quickbooks

- Shopify

- SalesForce

- Walmart

- stripe

These are just a few, TaxJar also has other Premier Certified Integration and Registered Certified Integrations.

Exclusive TaxJar Solutions

TaxJar provides solutions for all sizes of businesses and Industries. The tool's API works around the clock at sub-25ms with 99.99% uptime SLA, calculating instant accurate and updated tax rates at the checkout on every order. With automation and nexus, tracking helps you file taxes in various states and localities hassle-free. Your data's security cannot be threatened as the tool complies with GDPR, HIPAA, and SOC II frameworks. The tool works precisely in the busiest seasons and does not let that hamper its performance.

Their solutions can be beneficial for small businesses as well as medium and large enterprises. As for the industries, here are some of them:

- Retail

- Food and Beverage

- Medical

- SaaS

- Services

TaxJar Pricing Plans: Can you Use TaxJar for Free?

Now, looking at all the salient features offered by this advanced tax compliance software, one might assume that the price will be equivalent to that of hiring a professional accountant. But may I take the pleasure of informing you that it is not. Surprisingly, TaxJar pricing plans are super reasonable and affordable.

You can get a 30-day free trial of TaxJar, which allows full accessibility to its premium products. Additionally, You don't have to enter your credit card details to sign up.

Within the trial period, you get to experience all the features of its Professional Plan, along with TaxJar API access and integrations. The tool will import the sales data of the last 60 days to provide you with up-to-date reports. After the 30-day trial, TaxJar will charge you based on your business's number of orders monthly.

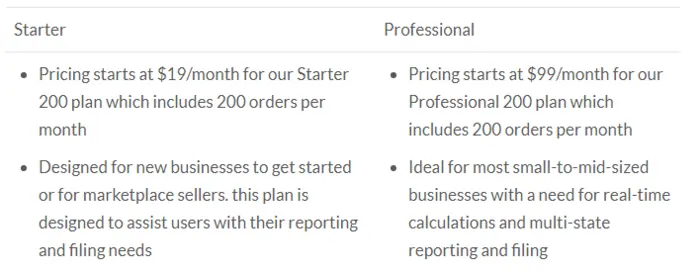

As for the Pricing plans, TaxJar only has two, Starter and Professional. Let's learn about them in detail.

TaxJar Starter Plan ($19/month)

- Designed for new sellers and businesses to help them with reporting and filing needs.

- Maximum 3 data import integrations.

- Helps with sales tax calculations, configured and handled by the platform.

- Adds product tax categories, Sales & Transactions Checker for nexus tracking and provides in-depth sales tax reporting.

- Provides 4 Auto files per year.

- Single-User Access, Multi-platform support, advanced CSV imports and Email support.

TaxJar Professional Plan ($89/month)

- All the features of the Starter Plan.

- Perfect for small-to-medium-sized businesses for enhanced calculation and filing.

- 10 total integrations (data import + API integrations)

- Helps with real-time sales tax calculations and multi-state filing and reporting.

- Transaction Insights tool does exportable sales tax reporting

- Additional features include Economic Nexus Insights tool, Sandbox Environment for ongoing testing, Address Validation, and VAT Calculation.

- Build custom integrations with TaxJar API.

- Maintains an archive of historical sales tax compliance data

- Provides 12 Auto-files per year.

- Multi-user access with particular roles.

- Phone support and email support with priority queues.

TaxJar Customer Service Review

The best way to analyze a product or service is by checking its customer response. TaxJar has earned a great reputation for the quality of its customer support, something they are rightly proud of. Their automated services with extreme accuracy are helpful to all business owners.

It is highly efficient, user-friendly, and interactive, so you don't really have to be tech-savvy to use it. Particularly when it comes to ascertaining state-wise sales tax and filing returns, TaxJar supersedes its competitors. Additionally, many users have remarked that TaxJar makes calculating sales tax and filing much simpler.

Professionals praise it for the excellent customer services they get at affordable prices. TaxJar helps you with sales tax compliance without hiring an accountant, thereby saving a lot of time and money.

Alternatives of TaxJar | What other Software can i use except TaxJar?

Xero | TaxJar Vs Xero

Xero is a cloud-based accounting software, especially for Amazon sellers looking to manage their everyday accounts. It also allows users to capture data, store files remotely, get detailed reports, monitor inventory, send invoices, complete multi-currency transactions, compute sales tax, analyze cash flow, and more. These advanced features help sellers and business owners to administer their bills and expenses. Moreover, it can be connected to a bank for effortless, secure transactions. Furthermore, users can classify and reconcile bank account transactions.

A2X Accounting | TaxJar Vs A2X Accounting

A2X Accounting is renowned automated accounting software that is highly compatible with many eCommerce systems. This software is an effective time-saver as it posts settlement summaries to accounting software like QuickBooks, Xero, and Sage. A2X is also a great choice for COGS and FBA inventory accounting, allowing you to monitor Amazon sales margin, calculate FBA inventory value, and manage Amazon pay accounting, among other tasks. The tool integrates well with major eCommerce platforms such as Amazon, Shopify, BigCommerce, Walmart, etc.

Bench | TaxJar Vs Bench

Bench is another top-notch bookkeeping and accounting software for business owners. This all-in-one financial service can be used to manage everything from bookkeeping to tax filing. In addition, they have partnered with some leading platforms such as Stripe, BigCommerce, Gusto, FreshBooks, Shopify, and more to give you a more seamless experience. You can keep an accurate record of all transactions with monthly financial statements and expense summaries available from Bench. Furthermore, the software is loaded with approximately 600 resources that are aimed at managing small business finances.

Top FAQs on TaxJar Review 2024

What eCommerce platforms are supported by TaxJar?

TaxJar supports a total of 15 official integrations, including Amazon, eBay, BigCommerce, ecwid, Etsy, Magneto, Paypal, QuickBooks, SalesForce, Shopify, Square, Squarespace, stripe, Walmart and WooCommerce.

Does TaxJar have a free plan?

No, as of now, TaxJar does not offer a free plan. But they have a 30-day free trial which allows users complete access to all the premium features of TaxJar.

What countries tax rates does TaxJar support?

The TaxJar API supports countries including the United States, Canada, Australia, and the European Union.

Conclusion: Do TaxJar Calculates Accurate Sales Tax?

TaxJar is a cloud-based sales tax compliance tool designed to help businesses and individuals manage their taxes, invoices, and sales. It provides an intuitive interface and comprehensive features to help users accurately calculate and file their taxes quickly and easily. With TaxJar, users can save time and money by avoiding costly mistakes and ensuring accuracy when filing taxes. Additionally, TaxJar integrates with popular ecommerce platforms, so users can easily keep track of their sales and manage them in one place.

You can't ignore the fact that the tool considers the jurisdictions and tax laws implied in each American state. It's already 2024, so ditch the manual work and digitalize your sales tax management with TaxJar.